If you are in need of a bad credit loan, even when you have a bad credit history, we can help. We have selected a panel of lenders who are able to assist people with good and bad credit histories, because we all have a past!

If you are experiencing financial difficulties, are worried about qualifying for a loan, or if you have an unstable credit history, LoanHut is the loan service provider that offers you a variety of lenders to compare products from. With us you are also able to obtain your credit record providing you with your latest credit score from three of South Africa’s biggest credit bureaus.Thisis useful as it may help you to see if you qualify for a loan before you apply.

Taking out a bad credit loan, is great for those with poor credit scores who struggle to obtain credit from mainstream banks and lenders. Here are a few reasons how a person can fall into the bad credit category:

These and other reasons can and will affect your credit score, but if you decide to try and manage it properly and responsibly, abad credit loan may help improve your credit score.

Our lenders take various factors into consideration when assessing your loan application and credit rating. This will include your financial activity over the past few years as well as your ability to repay the loan on a regular basis.

It important to note thatrepeated missed repayments on previous loans will likely have a negative impact on your application.

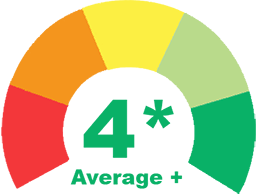

While people with a good credit score are more likely to be approved, those with a poorcredit score are either declined or offered a less than favourable lending rate.

Here are a few useful tips to help you improve your poor credit score:

Representative example: As an example, if you borrow R15,000 over 15 months at a fixed rate of 28% per annum and a fee of R68.40 per month and initiation fee of R1,197 this would result in a representative rate of 68% APR (fixed). The total amount repayable would be R22,717

Please note: we are NOT a lender - we are a loan broker working with the most reputable direct lenders in the market place to find you a loan. Our FREE service compares a wide range of lenders quickly, and finds you a lender that may be willing to lend to you today. Some lenders or brokers on our panel may charge you a fee to process your application.

Rates from 20% APR to 112% APR - we provide a no obligation loan searching service, your APR will be based on your personal circumstances. Loan repayment terms from 3 to 60 months.